Why Is There Excise Duty on Cars in Malaysia

A type of tax imposed on certain goods imported into or manufactured in Malaysia. These hefty excise duties are often blamed as the cause of high car prices in Malaysia.

Guide To Buy Car Insurance Online In Malaysia Ibanding Making Better Decisions Car Insurance Online Car Buying Car Insurance

In Malaysia no import duty is imposed for cars originating from Asean countries while 30 import duty is imposed on vehicles imported from non-Asean countries.

. The former ranges from 60 to 105 percent depending on vehicle type and engine capacity while the latter can reach up to 30 percent depending on the cars country of origin. Excise tax is an additional tax that needs to be paid when purchases are made on a specific item or good. The prices of locally assembled CKD cars will not increase come 2021.

What goods are subject to excise duty. New excise duty regulations may increase car prices by up to 20 from 2023. Heres a bit of good news to end the year.

So why are cars expensive in Malaysia. This is especially so for completely-knocked-down or. On the other hand import duty can reach up to 30 depending on the vehicles country of manufacture.

Whatever the case most Malaysians are still purchasing cars to make their lives easier and we all know how expensive imported cars can get. 21012020 in Featured Mainstream KUALA LUMPUR. Industry players have already pressed the alarm bells that such a move to increase the excise duty will markedly increase car prices.

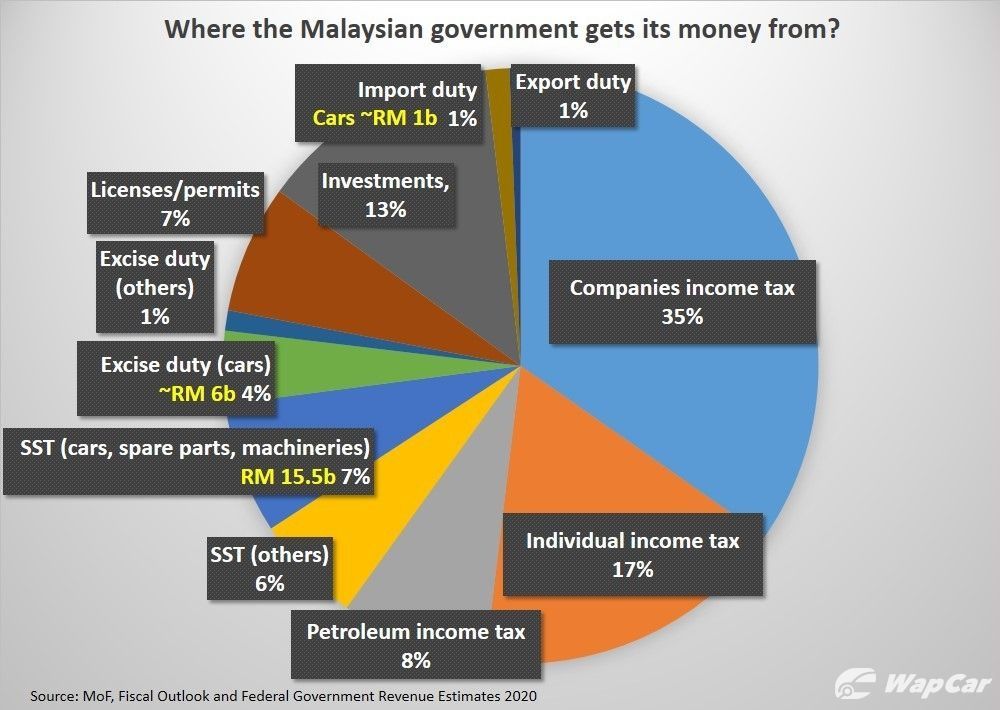

Reuters Aside from the sales tax vehicles sold are also charged with other taxes namely excise duty and import duty. MFN Most Favoured Nation rate. At present the excise duty is set at between 60 to 105for both locally assembled and imported cars and it is calculated based on the car model and engine capacity.

This compares with a current import duty of 42 percent and. OTHER MOTOR CARS MALAYSIA. To be fair yes its mostly due to currency exchange rate which make import cars just regular ones doesnt need to be luxury car very expensive but how about Malaysia made cars like from proton or produa.

What is the excise duty. On top of sales tax depending on the car and its engine capacity excise duty is levied between 60 and 105. This was confirmed by the President of Malaysian Automotive Association MAA.

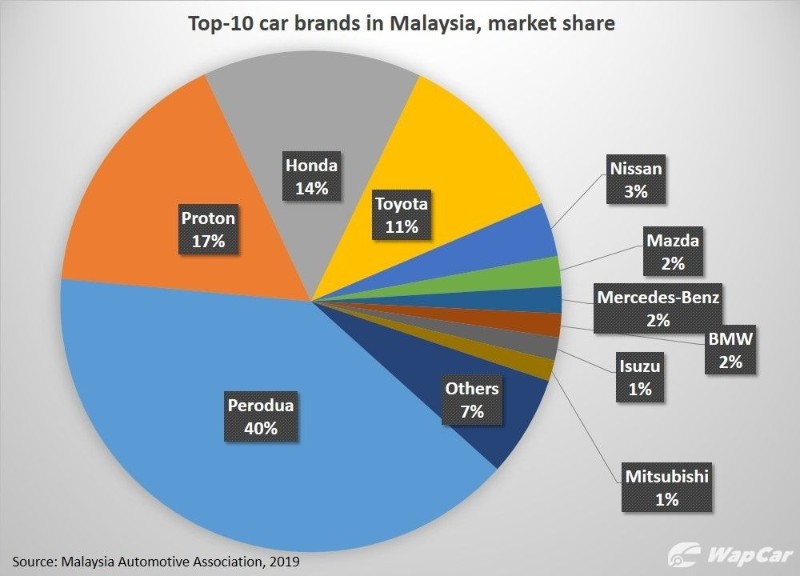

The MAA anticipates a 2 growth for total industry volume following continuous demand for new model of vehicles and aggressive promotional campaign by automotive companies. Cigarettes tobacco and tobacco products. He however assured that should there be any changes these will not affect the current excise duty rate.

So why are they so expensive. Fortunately vehicles from ASEAN countries are not imposed with import duty. Originally new excise duty regulations set by the customs department wouldve increased prices of CKD cars next year but this is no longer the case.

In this case it would be on the imported car. GST shall be levied and charged on the taxable supply of goods and services. What is Excise Duty.

Its not as much as you think. The government has yet to reach an agreement on the restructuring of its excise duty policy involving locally-assembled vehicles Finance Minister Lim Guan Eng said today. Excise Duties Sales Tax All 30 0 NIL 0 NIL 10 Notes.

The same CKD car imported from non-ASEAN countries will now be subjected to an import duty of 35 percent and an excise duty of 60 percent. The price of a car is determined by its manufacturer taking into consideration various factors and market forces. At present imported cars are subject to an excise duty of between 60 and 105 based on the model and engine capacity while import duty can be.

You can check the current rates from the MAA website for motor cars excluding 4WDs and MPVs the duty ranges from 75 for 18 litre cars to 105 for cars with engines larger than 25 litres. To put into perspective cheap new car made in Malaysia standard is around 40-60K Malaysian ringgit And Cars made in America is around. Excise duties collection in 2020 is expected to increase 49 to RM 11 billion due to higher demand for motor vehicles.

KUALA LUMPUR Oct 29 -- The government intends to provide full exemption on import and excise duties as well as sales tax for electric vehicles EV to support development of the local EV industry. It is the excise tax. On the face of it excise duties are an onerous addition to the price of Malaysian cars.

DUTIES TAXES ON MOTOR VEHICLES A PASSENGER CARS INCLUDING STATION WAGONS SPORTS CARS AND RACING CARS CBU CKD CBU CKD IMPORT DUTY. GST shall be levied and charged on the taxable supply of goods and services. Excise and import duties are not exempted Image.

12102019 23630 PM.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

We Pit A 5 Year Old Myvi Mercedes Benz C Class Honda Civic Toyota Vios And Mini Cooper Against Each Other The Winner Honda Civic Toyota Vios Toyota Innova

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Perodua Tax Holiday Peninsular Malaysia Compact Suv

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

0 Response to "Why Is There Excise Duty on Cars in Malaysia"

Post a Comment